The comprehensive analysis of cruise ship activity in Bergen, Norway, for the year 2024 provides valuable insights into the operational dynamics of the cruise industry and its implications for local tourism and economic activities. Through detailed data exploration and visualization, we've uncovered several key aspects of cruise traffic, market share, and seasonal trends in Bergen. Here's an introduction and a summary of our findings:

Introduction

Bergen, known for its stunning natural beauty, cultural heritage, and strategic location along the Norwegian coast, serves as a crucial gateway for maritime tourism in Norway. The analysis aimed to dissect the patterns of cruise ship arrivals, the volume of passengers, and the engagement of various cruise lines in the Bergen port area for 2024. By doing so, it offers stakeholders, from local businesses to policymakers and tourism operators, a solid foundation to strategize and enhance Bergen's appeal and readiness as a premier cruise destination.

Key Figures for 2024:

A total of 60 different cruise ships are scheduled to visit Bergen, with 287 cruise ship calls anticipated throughout the year. These visits are expected to bring approximately 542,473 passengers, supported by 27 distinct cruise lines operating in the region.

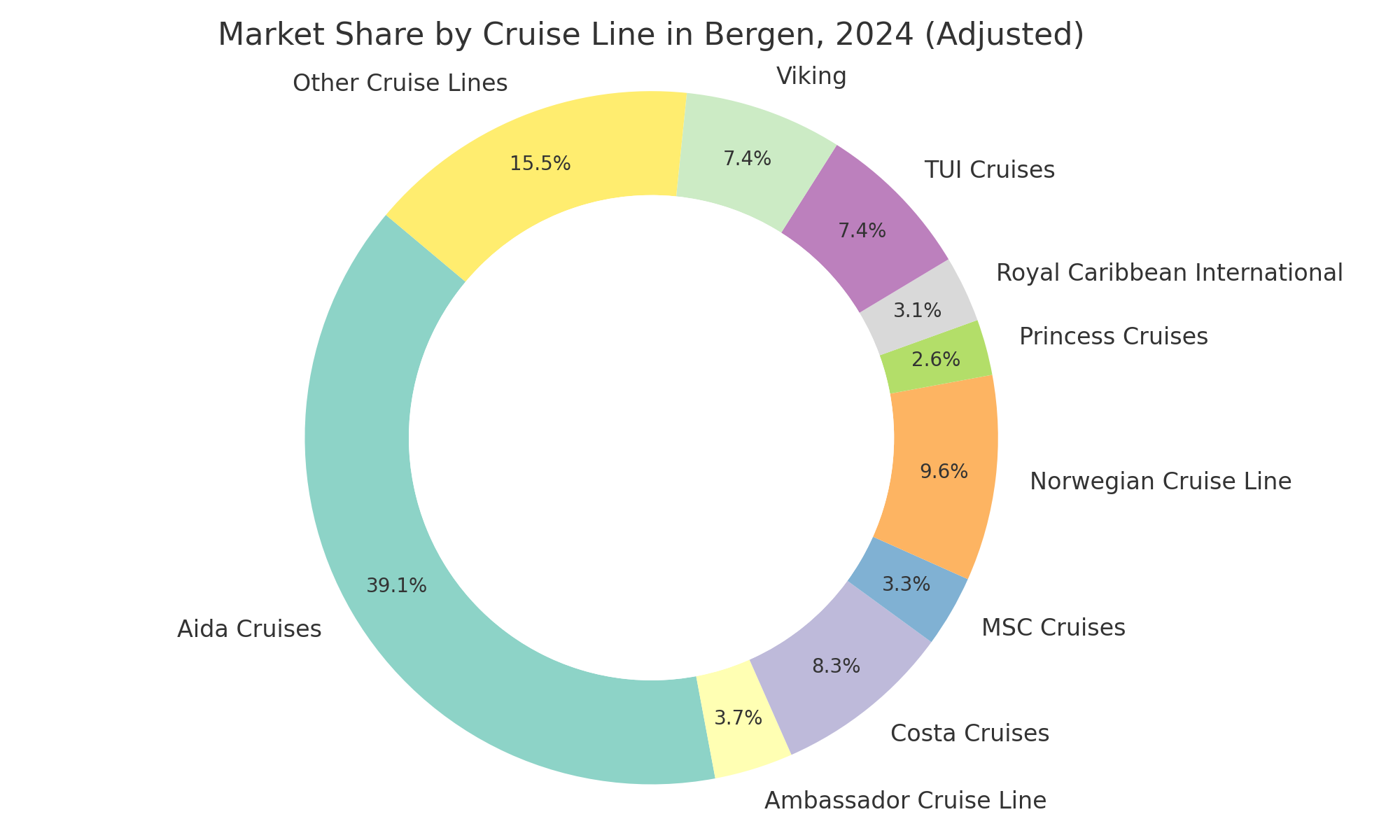

Cruise Lines Market Share Analysis:

| Cruise Lines Market Share in Bergen | ||||

| Cruise Line | Total Passengers | Unique Cruise Ships | Cruise Ship Calls | Market Share (%) |

| Aida Cruises | 211,896 | 8 | 71 | 39.06% |

| Norwegian Cruise Line | 52,054 | 2 | 17 | 9.60% |

| Costa Cruises | 45,264 | 1 | 12 | 8.34% |

| TUI Cruises | 40,180 | 4 | 16 | 7.41% |

| Viking | 39,904 | 6 | 43 | 7.36% |

| Ambassador Cruise Line | 19,908 | 2 | 14 | 3.67% |

| MSC Cruises | 18,156 | 2 | 6 | 3.35% |

| Royal Caribbean International | 16,796 | 3 | 5 | 3.10% |

| Princess Cruises | 14,142 | 2 | 4 | 2.61% |

| Holland America Line | 13,340 | 1 | 5 | 2.46% |

| Phoenix Reisen | 11,794 | 3 | 14 | 2.17% |

| Cunard | 11,444 | 2 | 4 | 2.11% |

The market share analysis highlighted Aida Cruises as the dominant player, responsible for a significant portion of the passenger volume, followed by notable contributions from Norwegian Cruise Line and Costa Cruises. The diversity of cruise lines underscores Bergen's broad appeal across different market segments.

Top 20 Cruise Ships:

The analysis of the top 20 cruise ships, based on the number of calls and passenger volumes, revealed key vessels like AIDAperla and Norwegian Prima leading in terms of visits. This insight into ship-specific activity aids in understanding which operators are most influential in Bergen's cruise ecosystem.

| Top 20 cruise ships with most stops in Bergen | ||

| Cruise Ship | Number of Calls | Total Passengers |

| AIDAperla | 14 | 46,004 |

| Norwegian Prima | 14 | 45,010 |

| Viking Venus | 14 | 12,992 |

| Costa Diadema | 12 | 45,264 |

| AIDAsol | 12 | 26,328 |

| AIDAdiva | 12 | 24,600 |

| AIDAnova | 11 | 59,400 |

| MS Maud | 11 | 5,500 |

| Viking Neptune | 9 | 8,352 |

| Silver Dawn | 9 | 5,184 |

| AIDAprima | 8 | 26,288 |

| Mein Schiff 3 | 8 | 20,048 |

| Viking Sky | 8 | 7,424 |

| Ambience | 7 | 11,172 |

| Ambition | 7 | 8,736 |

| Viking Saturn | 7 | 6,496 |

| National Geographic Explorer | 7 | 1,036 |

| Amera | 6 | 5,010 |

| Le Champlain | 6 | 1,104 |

| ms Rotterdam | 5 | 13,340 |

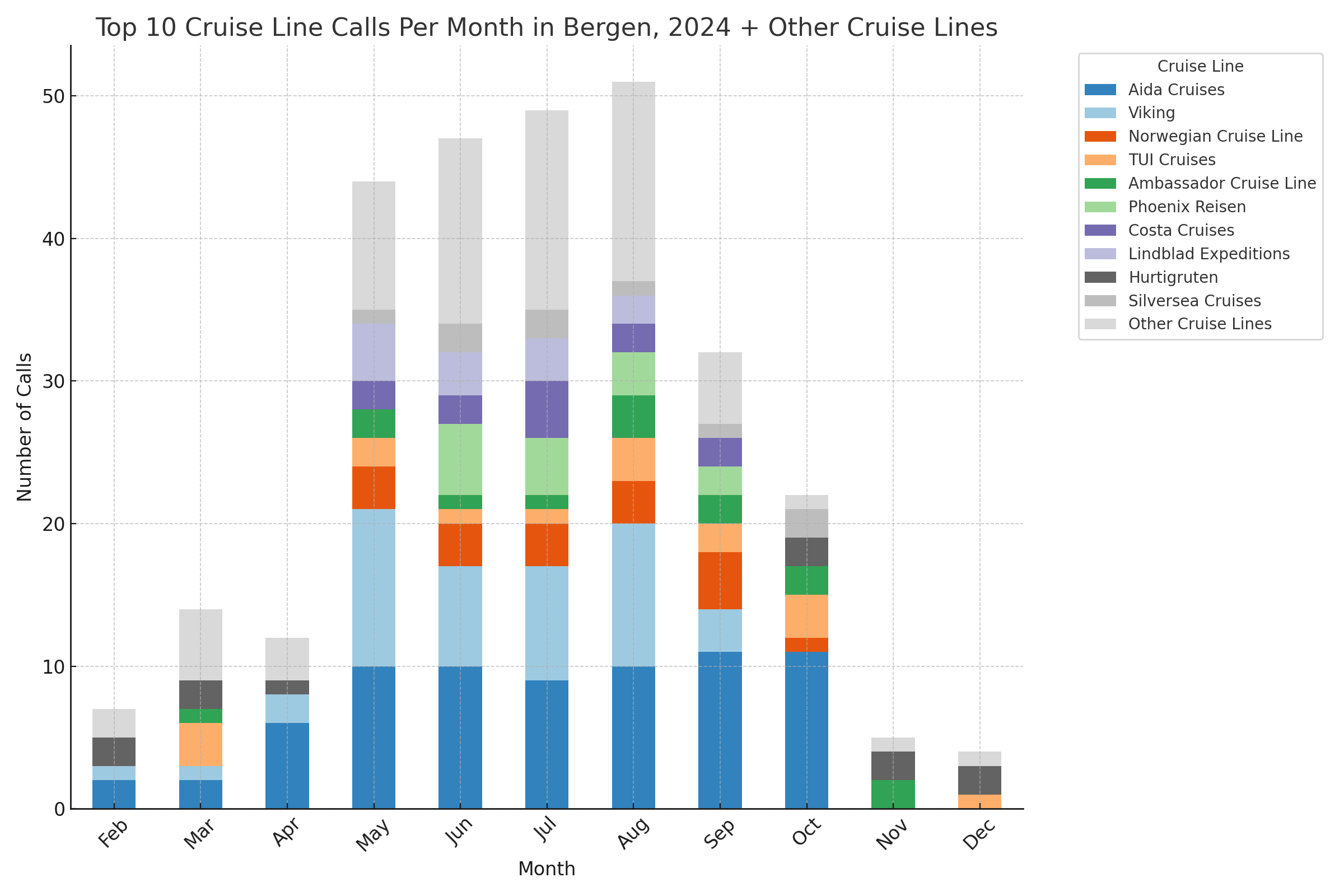

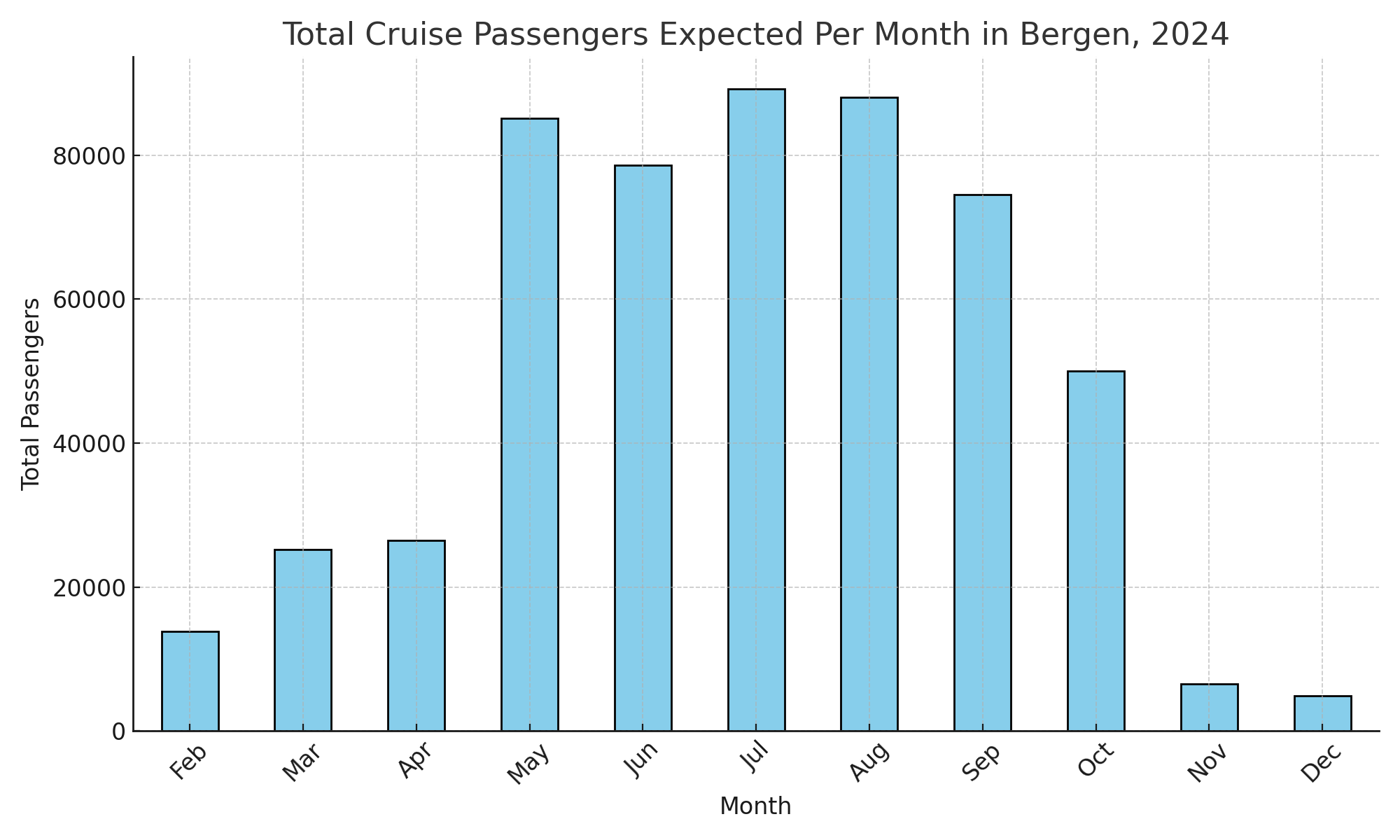

Seasonal Passenger Trends:

A clear seasonal pattern emerged from the monthly analysis of expected cruise passengers, with peak activity in the summer months of June, July, and August. This seasonality is crucial for planning and optimizing tourism-related services and infrastructure to accommodate the influx of visitors effectively.

Detailed Cruise Lines Contributions: