Norwegian Cruise Line Holdings (NCLH) is under serious pressure after activist investor Elliott Investment Management revealed it has built a stake of more than 10% in the company, making it one of Norwegian’s biggest shareholders, reported Cruise Industry News. And Elliott isn’t staying quiet. They’re calling for major leadership and board changes.

In a presentation titled “Norwegian NOW,” Elliott accused Norwegian’s leadership of overseeing more than a decade of poor performance, bad decisions, and weak corporate governance.

Investor confidence at rock bottom

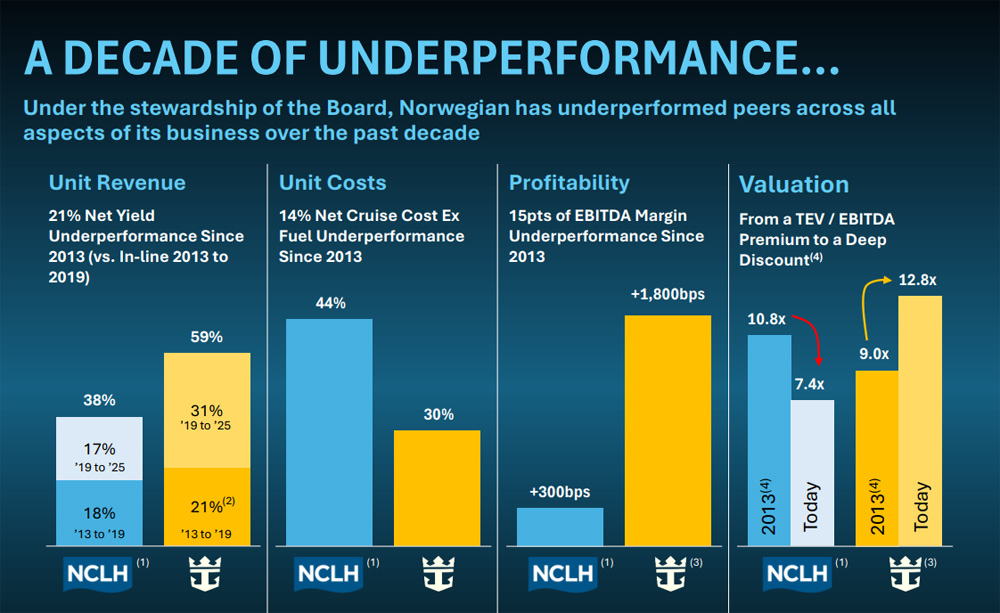

According to Elliott, Norwegian has fallen far behind its cruise competitors in recent years. Once seen as a strong player, the company is now struggling financially and has lost investor confidence.

Some of the biggest concerns raised include:

- Norwegian’s stock has underperformed competitors by 230% over the past three years

- The company now trades at one of the lowest valuations in the entire S&P 500

- Rising costs, missed targets, and strategic mistakes have hurt overall performance

Elliott says these problems are the result of leadership failures at the top.

Board under fire for leadership decisions

One of Elliott’s main criticisms is aimed directly at Norwegian’s Board of Directors, which they say has repeatedly chosen the wrong leaders.

The firm pointed to the recent appointment of John Chidsey as CEO, a longtime board member who has no executive experience in the cruise industry. Elliott described the move as rushed and said it only created more uncertainty about the company’s future.

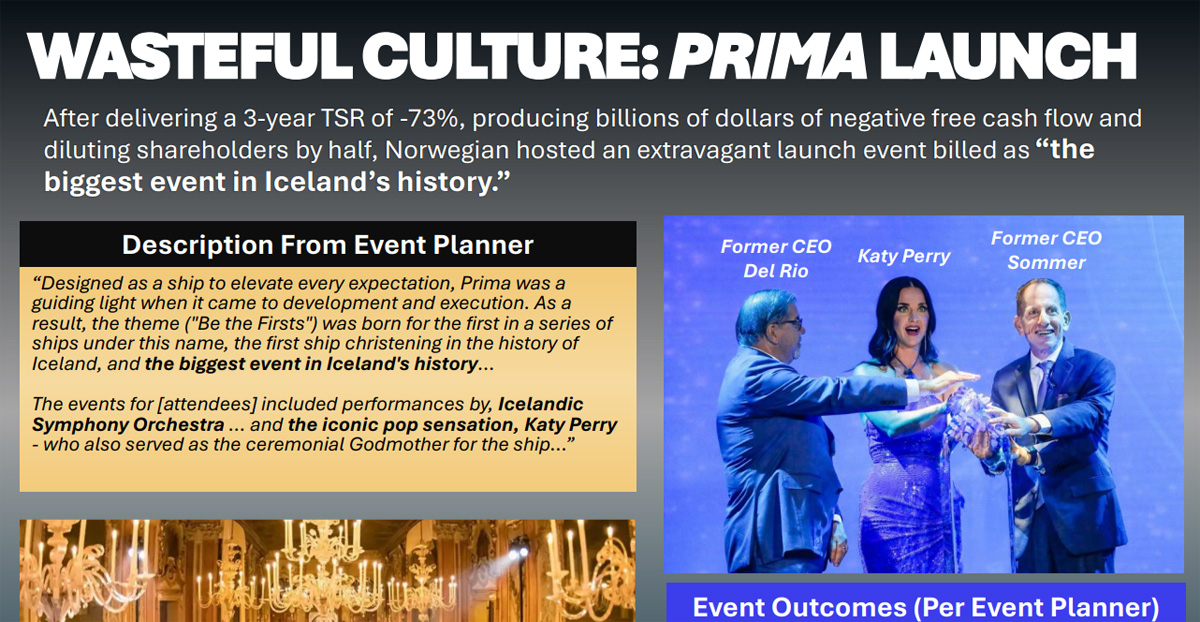

Previous CEOs Frank Del Rio and Harry Sommer were also criticized, with Elliott claiming their strategies led to falling stock value, poor execution, and declining investor trust.

Millions spent on events and artwork while performance declined

Elliott’s report also called out what it described as wasteful spending during a time of weak financial performance. This included:

- Expensive ship launch events costing millions

- Tens of millions spent on art collections for ships

- Strategic decisions that didn’t match industry trends

The firm said Norwegian missed key opportunities that competitors successfully used to grow, such as investing more aggressively in private island destinations and larger ships.

Corporate governance and executive pay questioned

Elliott also raised concerns about executive compensation and governance, claiming leadership was rewarded despite poor results.

The report pointed to large consulting payments to former executives and controversial business deals involving former board members. Elliott also criticized the company’s board structure, which makes it harder for shareholders to replace directors.

Elliott says Norwegian can recover—but only with major changes

Despite the harsh criticism, Elliott said it believes Norwegian still has strong brands, valuable ships, and hardworking frontline crew. However, the firm insists that real change is needed to turn things around.

Elliott is calling for:

- Major changes to the Board of Directors

- A full review of executive leadership

- A new business strategy focused on improving profits

The investor believes these changes could potentially boost Norwegian’s stock value significantly—possibly reaching $56 per share, which would represent a major recovery.

Major leadership shake-up could be coming

With Elliott now holding more than 10% of the company, Norwegian could soon face a major leadership battle. Activist investors often push aggressively for change, and their involvement increases the chances of boardroom shake-ups.

For Norwegian Cruise Line Holdings, this could be a turning point that reshapes the company’s leadership, strategy, and future direction.